Canada’s Kiwetinohk posts strong Q4, 2021 results

SUMMARY

Two energy transition projects are close to final investment decisions.

By Dale LunanPOSTED IN:

Canada’s Kiwetinohk Energy, created in June 2021 from the merger of two related companies, reported March 24 record adjusted funds flow in 2021 along with “transformative” acquisitions and progress on several energy transition projects.

“Kiwetinohk significantly increased its production and reserves in 2021 through counter-cyclic acquisitions and is also seeing the early results of a successful winter drilling program,” CEO Pat Carlson said. “As we position the company within the energy transition, the green energy team also delivered excellent progress on its power development portfolio, hitting key project development and regulatory approval process milestones on our first solar and high-efficiency natural gas-fired power projects.”

Kiwetinohk Energy is the result of the combination last summer of Kiwetinohk Resources and Distinction Energy (previously Delphi Energy) with the intent to pursue carbon-free energy solutions, including renewable electricity and blue and green hydrogen.

Primarily a natural gas producer – its 32.9mn ft3/day of gas production in 2021 accounted for 56% of corporate production – Kiwetinohk’s longer-term goal is to provide consumers with clean, reliable and dispatchable low-cost energy.

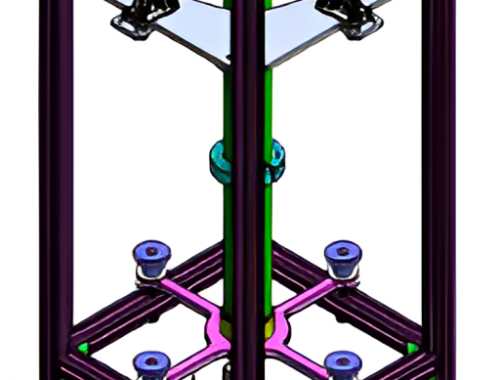

In pursuit of that goal, it has five solar and gas-fired power projects at various stages of engineering and regulatory development. Regulatory applications are anticipated in the second quarter for a 101 MW gas-fired facility incorporating a carbon capture and storage (CCS) pilot (what Kiwetinohk calls a firm renewable project) and a 400 MW solar generating facility.

Pending regulatory approvals and financing, final investment decisions on both are expected in Q4 2022 and Q3 2022, respectively, with commercial operations targeted for Q4 2024. A 300 MW solar facility and a pair of 500 MW natural gas combined cycle generating stations are targeted for commercial operations between Q2 2025 and Q3 2027.

In 2021, Kiwetinohk reported a net loss of C$22.3mn (US$17.8mn) but record adjusted funds flow from operations (AFFO) of C$69.8mn. In Q4 2021, it had net income of C$44.3mn and AFFO of C$30.8mn.

Total capital expenditures in 2021 amounted to C$333.3mn, including C$282.4mn of acquisitions, primarily for additional Duvernay and Montney producing assets.