RSG: Is it becoming the ‘new normal’?

SUMMARY

Certified gas is a growing force in the North American natural gas industry. What does the future hold for responsibly sourced gas.

By Mike WeberPOSTED IN:

Featured Americas Commercial Innovation Canada United States

In the past two years, a number of platforms have emerged to certify various parts of the natural gas value chain, growing responsibly sourced gas in the industry vernacular. Recently, Mike Weber, a communications professional deeply versed in sustainable finance, renewable energy and ESG, sat down with Chris Romer, co-founder and CEO of Project Canary, to discuss the emergence of RSG for Gas Pathways.

Q: Responsibly sourced gas is in its infancy. Tell us about how the idea of certified gas was born?

A: Responsibly Sourced Gas (RSG) is natural gas that has undergone independent third-party assessment that molecules were produced under specified environmental best practices. This means calculating methane intensity, freshwater usage, and other climate factors to help producers meet standards set by gas buyers, academics, and other stakeholders.In 2018, SWN struck a deal with New Jersey Natural Gas to sell environmentally responsible gas at a premium in the first-ever certified gas deal. The company that certified that gas, Independent Energy Standards, is now a part of Project Canary. What started as a single transaction has now grown into a fully-fledged market, with deals in the US and abroad making headlines. We have over 60 customers in the upstream (production) and midstream (pipeline) sectors engaged in various stages, from pilot projects to full-scale adoption of certification and site-level monitoring. The market for RSG, or certified gas, has grown to 25-30% of the US gas market. Buyers, including domestic and international utilities, recognise the opportunity that RSG presents for them to influence the market with their buying power and positively impact climate change. We've been on the front end of this market from the beginning, and we're proud to have customers who value what we do – granular, site-level data with verifiable climate attributes.

Q: RSG has seen a meteoric rise in just a few years. What do you believe are the biggest factors driving its growing popularity?

A: From financial incentives to shifting consumer preferences to the need for climate accountability, countless factors are driving the RSG market forward. Operators and buyers will continue to face pressure from the market, communities, investors, and regulators to differentiate molecules. Pending US and EU regulations have also brought conversations surrounding RSG/certified gas to the forefront. The market has recognized that emission estimates are no longer enough. Estimates are being replaced with actual measurements, enabled by technological advancement in site-level (fixed/continuous monitors), aerial (drones/aircraft), and terrestrial (satellite) measurements. Together, these technologies can provide a representative sample of total site-level emissions, providing operational insights to identify, remediate and eliminate emissions. Registries, too, are driving the demand for RSG since they manage digital gas trades. Producers and buyers of differentiated gas commodities (“RSG”) want to understand the environmental footprint of the molecules they sell or purchase. This requires documentation, tracking, and book-and-claim capabilities. By providing granular, transactable data, platforms like EarnDLT are driving the RSG market forward.

Q: Technologically, what’s been the biggest development supporting RSG?

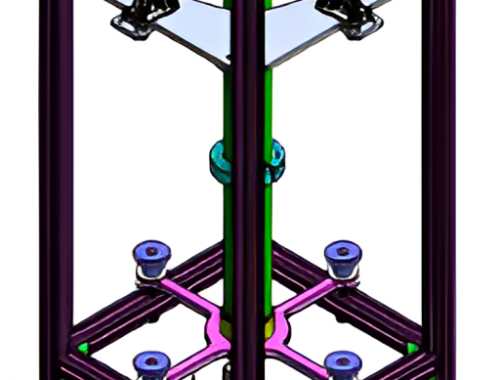

A: There are many different approaches to measurement in support of RSG. We've always been a proponent of site-level measurement. Operators have different goals, and specific sites have different needs. We believe in utilising a “digital canopy” of monitoring technology that marries site-level measurement with other data streams, including satellites, flyovers, and various types of continuous monitoring devices, into one view of total site emissions. Advances in individual monitoring technologies and the integration of those findings into a total emissions picture enable accuracy and reporting. The digitisation of this data to registries is an equally important development. This open and integrated approach to emissions technology allows us to work with customers on monitoring programmes that fit their needs.The industry's future depends on transparency – that’s why we’re building an open data platform to integrate all types of emissions monitoring and measurement technologies.

Q: What are the biggest hurdles certified gas must overcome right now for wider uptake?

A: Focusing on accurate site-level measurement versus estimates will be crucial as the market evolves. We must ensure that data remains at the heart of differentiated gas. Without actual site-level measurement, accusations of greenwashing (especially basin-wide) become an imminent threat – plus, we’ve all seen the doubts raised about nature-based offsets in the past few months. Relying on auditable, granular emissions and climate data will help us build the trust needed to fuel the energy transition by using transparency and transactability as a reliable backbone for stakeholders.

Q: Inevitably, there will be sceptics of the green credentials of RSG with criticism beginning to emerge over a lack of unified standards and self-certification. What do you say to those who claim it’s feel-good branding and not meaningfully impacting decarbonisation?

A: We believe in the actual measurement of total site-level emissions instead of basin-wide estimates. There is no room for estimates in a measurement-based energy economy. We view this as the three Ts: Trust, Transparency, and Transactability. Avoiding claims of greenwashing means committing to these principles. Transparency starts with real measurement at the site level, which builds trust and enables transactability for markets.

Q: What is needed to get more operators on board with RSG, particularly smaller operators who are on tighter margins and may balk at the added costs of measurement and monitoring?

A: Small and medium-sized oil and gas operators face different challenges than the majors, including tighter profit margins. But one thing that can help improve the bottom line, even for the smallest of operators, is monitoring methane leaks. Transparency, market development, regulatory advances, and pressure from multiple stakeholders will continue to be key drivers. We believe RSG is critical for the industry’s social licence to operate and to remain a viable source of energy through the energy transition.

Advances in leak detection and repair technology mean that operational excellence and environmental stewardship can go hand in hand with capturing additional value from lost gas. Currently, 2-3% of natural gas produced by the US oil and gas industry is lost yearly due to leaks. Capturing this wasted methane for sale could generate additional revenue.

The Inflation Reduction Act provides $1.5bn to help with methane mitigation, $700mn of which is reserved for marginal conventional wells (note that the EPA has yet to determine how these funds will be allocated; that direction will likely come in the second half of 2023). Grants are available to help with the cost of certifying natural gas from the Alberta Methane Emissions Program. This means that methane monitoring can benefit even the smallest operators and oldest wells.

Q: From a strictly economic viewpoint, do you see a price premium developing for RSG? Or a case in the future where non-RSG gas is sold discounted?

A: We have seen premiums for RSG in the market and believe they will continue for the foreseeable future, particularly in light of state legislatures and public utility commissions authorising opportunities for utilities to recover costs associated with certification. Looking forward, we see the market tiering based on the quality and rigor of their emissions and environmental data attributed to the gas from upstream through midstream and even to the city gate. Gas without any demonstrable environmental attributes could trade at a discount. We believe there is justification in the market for a premium for RSG based on continuous, site-level measurement that provides quantification of emission leaks at the pad-level.

Q: What is the next stage of evolution for RSG?

A: As RSG expands, we expect to see the separation of the physical gas molecules from climate attribute data so that they can be distributed and traded separately. This means that the buyer of the natural gas can optionally purchase the claims to climate attributes to differentiate their offering and achieve environmental goals. This optionality will help grow the market, incentivising more energy producers to produce RSG by rewarding and documenting their efforts to improve their environmental impact. As we look to the next phase of energy development, including blue hydrogen, we believe that highly granular and measured emissions data will be foundational for feedstocks and projects to qualify for tax credits.

Q: Where do you see the biggest opportunity in RSG in the future?

A: The next stage for RSG is expanding into other products that are part of the energy transition – we expect to see RSG used in methanol and blue hydrogen. The future is all about measured pathways to net zero and using low methane and low carbon gas to create dense energy products that will fuel the energy transition.